CALGARY, ALBERTA – Headwater Exploration Inc. (the “Company” or “Headwater“) (TSX:HWX) is pleased to announce its operating and financial results for the three and six months ended June 30, 2022. Selected financial and operational information is outlined below and should be read in conjunction with the unaudited condensed interim financial statements and the related management’s discussion and analysis (“MD&A”). These filings will be available at www.sedar.com and the Company’s website at www.headwaterexp.com.

Financial and Operating Highlights

Three months ended June 30, | Percent Change | Six months ended June 30, | Percent Change | ||||

2022 | 2021 | 2022 | 2021 | ||||

Financial (thousands of dollars except share data) | |||||||

Sales, net of blending (1) (4) | 122,102 | 37,429 | 226 | 232,124 | 60,552 | 283 | |

Adjusted funds flow from operations (2) | 79,435 | 23,182 | 243 | 149,458 | 37,661 | 297 | |

Per share – basic | 0.35 | 0.12 | 192 | 0.67 | 0.19 | 253 | |

– diluted | 0.34 | 0.10 | 240 | 0.65 | 0.17 | 282 | |

Cash flow provided by operating activities | 84,728 | 23,232 | 265 | 145,417 | 36,015 | 304 | |

Per share – basic | 0.37 | 0.12 | 208 | 0.65 | 0.18 | 261 | |

– diluted | 0.36 | 0.10 | 260 | 0.63 | 0.16 | 294 | |

Net income (loss) | 48,412 | 4,588 | 955 | 90,775 | (8,205) | nm | |

Per share – basic | 0.21 | 0.02 | 950 | 0.41 | (0.04) | nm | |

– diluted | 0.21 | 0.02 | 950 | 0.39 | (0.04) | nm | |

Capital expenditures (1) | 30,860 | 16,781 | 84 | 112,817 | 54,053 | 109 | |

Adjusted working capital (2) | 130,206 | 69,697 | 87 | ||||

Shareholders’ equity | 492,145 | 268,191 | 84 | ||||

Weighted average shares (thousands) | |||||||

Basic | 226,168 | 197,445 | 15 | 223,702 | 196,389 | 14 | |

Diluted | 233,479 | 213,905 | 9 | 230,957 | 196,389 | 18 | |

Shares outstanding, end of period (thousands) | |||||||

Basic | 229,908 | 202,286 | 14 | ||||

Diluted (5) | 241,585 | 240,257 | 1 | ||||

Operating (6:1 boe conversion) | |||||||

Average daily production | |||||||

Heavy crude oil (bbls/d) | 10,637 | 6,185 | 72 | 10,620 | 4,793 | 122 | |

Natural gas (mmcf/d) | 6.4 | 2.3 | 178 | 8.6 | 5.4 | 59 | |

Natural gas liquids (bbl/d) | 66 | 5 | 1220 | 36 | 5 | 620 | |

Barrels of oil equivalent (9) (boe/d) | 11,772 | 6,565 | 79 | 12,091 | 5,690 | 112 | |

Average daily sales (6) (boe/d) | 11,705 | 6,653 | 76 | 12,050 | 5,715 | 111 | |

Netbacks ($/boe) (3) (7) | |||||||

Operating | |||||||

Sales, net of blending (4) | 114.63 | 61.83 | 85 | 106.43 | 58.53 | 82 | |

Royalties | (23.85) | (8.84) | 170 | (19.37) | (7.45) | 160 | |

Transportation | (4.07) | (8.21) | (50) | (4.49) | (7.31) | (39) | |

Production expenses | (5.66) | (4.89) | 16 | (5.72) | (5.19) | 10 | |

Operating netback (3) | 81.05 | 39.89 | 103 | 76.85 | 38.58 | 99 | |

Realized gains (losses) on financial derivatives | (0.24) | 0.24 | (200) | (1.93) | (0.39) | 395 | |

Operating netback, including financial derivatives (3) | 80.81 | 40.13 | 101 | 74.92 | 38.19 | 96 | |

General and administrative expense | (1.52) | (1.60) | (5) | (1.50) | (1.76) | (15) | |

Interest income and other (8) | 0.44 | (0.23) | (291) | 0.29 | (0.03) | (1067) | |

Current tax expense | (5.16) | – | 100 | (5.19) | – | 100 | |

Adjusted funds flow netback (3) | 74.57 | 38.30 | 95 | 68.52 | 36.40 | 88 | |

(1) Non-GAAP measure. Refer to “Non-GAAP and Other Financial Measures” within this press release.

(2) Capital management measure. Refer to “Non-GAAP and Other Financial Measures” within this press release.

(3) Non-GAAP ratio. Refer to “Non-GAAP and Other Financial Measures” within this press release.

(4) Heavy oil sales are netted with blending expense to compare the realized price to benchmark pricing while transportation expense is shown separately. In the interim financial statements blending expense is recorded within blending and transportation expense.

(5) In-the-money dilutive instruments as at June 30, 2022 includes 7.2 million stock options with a weighted average exercise price of $2.51 and 3.5 million warrants issued pursuant to the recapitalization transaction in March 2020 with an exercise price of $0.92, 0.2 million restricted share units and 0.8 million performance share units.

(6) Includes sales of unblended heavy crude oil, natural gas and natural gas liquids. The Company’s heavy crude oil sales volumes and production volumes differ due to changes in inventory.

(7) Netbacks are calculated using average sales volumes. For the three months ended June 30, 2022, sales volumes comprised of 10,571 bbs/d of heavy oil, 6.4 mmcf/d of natural gas and 66 bbls/d of natural gas liquids (2021- 6,273 bbls/d, 2.3 mmcf/d and 5 bbls/d). For the six months ended June 30, 2022, sales volumes comprised of 10,579 bbls/d of heavy oil, 8.6 mmcf/d of natural gas and 36 bbls/d of natural gas liquids (2021- 4,818 bbls/d, 5.4 mmcf/d and 5 bbls/d).

(8) Excludes unrealized foreign exchange gains/losses, accretion on decommissioning liabilities, interest on lease liability and interest on repayable contribution.

(9) See ‘”Barrels of Oil Equivalent.”

(10) Nm = not meaningful.

SECOND QUARTER 2022 HIGHLIGHTS

- Realized record adjusted funds flow from operations (1) of $79.4 million ($0.35 per share basic) and cash flows from operating activities of $84.7 million ($0.37 per share basic) representing an increase of 243% and 265%, respectively, over the second quarter of 2021.

- Recognized net income of $48.4 million ($0.21 per share basic) representing an increase of over 950% from the second quarter of 2021.

- Generated free cash flow (3) of $48.6 million.

- Achieved a record operating netback (2) of $81.05/boe and an adjusted funds flow netback (2) of $74.57/boe representing an increase of 103% and 95%, respectively, over the second quarter of 2021.

- Production averaged 11,772 boe/d (consisting of 10,637 bbls/d of heavy oil, 6.4 mmcf/d of natural gas and 66 bbls/d of natural gas liquids) representing an increase of 79% from the second quarter of 2021.

- Executed a $30.9 million capital expenditure (3) program including 5 successful Clearwater A wells in Marten Hills West plus 9 injection wells and 4 water source wells in Marten Hills as part of Headwater’s enhanced oil recovery acceleration project.

- Headwater has been approved for total funding of up to $18.5 million from Natural Resources Canada associated with the Emissions Reduction Fund program for infrastructure spend related to the elimination of venting and flaring of methane rich natural gas in the Company’s core area of Marten Hills.

- As at June 30, 2022, Headwater had adjusted working capital (1) of $130.2 million, working capital of $127.1 million and no outstanding bank debt.

(1) Capital management measure. Refer to “Non-GAAP and Other Financial Measures” within this press release.

(2) Non-GAAP ratio that does not have any standardized meaning under IFRS and therefore may not be comparable with the calculation of similar measures of other entities. Refer to “Non-GAAP and Other Financial Measures” within this press release.

(3) Non-GAAP measure that does not have any standardized meaning under IFRS and therefore may not be comparable with the calculation of similar measures of other entities. Refer to “Non-GAAP and Other Financial Measures” within this press release.

Operations Update

Marten Hills West

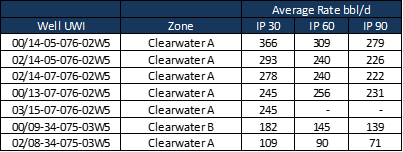

In the second quarter of 2022, Headwater rig released and successfully placed on production 5 Clearwater A wells in Marten Hills West elevating July production levels to 1,600 bbls/d. Year to date, 13 wells have been drilled in Marten Hills West at a 100% success rate. A further 19 development and step out locations are scheduled to be drilled over the balance of 2022. Our first Clearwater A water injection pilot is scheduled to be drilled and commissioned prior to year-end 2022.

Recent well results are as follows:

(1) Initial Production (“IP”) rates indicate the days the well is on production post load recovery.

Greater Peavine Area

Headwater has added an additional 6.75 sections of land in Peavine at recent land sales increasing our total land position in the Greater Peavine area to 110 sections. Headwater has identified more than 10 distinct prospects on this acreage and will add a fourth rig to drill 8 wells, testing 8 prospects starting early in the fourth quarter of 2022.

Marten Hills

Development in Marten Hills continues to focus on secondary recovery with 9 horizontal injection wells, 4 water source wells and 1 production well drilled in the second quarter. The field currently has 3.5 sections with active water injection representing 35% of the field under secondary recovery. Headwater is on track to have 65% of the field under waterflood in the first half of 2023.

McCully

McCully was shut-in May 1st, 2022 and will be re-started in the fourth quarter to capitalize on winter 2023 premium gas prices which are currently > Cdn $30/mscf.

Outlook

Our 2022 program continues to progress on schedule and on budget. Capital expenditures for 2022 will remain at $230 million with corresponding expected annual production of 13,000 boe/d (11,900 bbls/d of heavy oil and 6.8 mmcf/d of natural gas) and expected fourth quarter production of 16,500 boe/d (15,200 bbls/d of heavy oil and 7.9 mmcf/d of natural gas) as previously released. Due to a decline in forecast commodity pricing, forecast 2022 adjusted funds flow from operations has decreased to $295 million resulting in forecast exit adjusted working capital of approximately $160 million.

Previous 2022 Guidance | Revised 2022 Guidance | |

2022 annual production (boe/d) | 13,000 | 13,000 |

2022 fourth quarter (boe/d) | 16,500 | 16,500 |

Capital expenditures (1) | $230 million | $230 million |

Adjusted funds flow from operations (2) | $305 million | $295 million |

Exit adjusted working capital (2) | $170 million | $160 million |

(1) Non-GAAP measure. Refer to “Non-GAAP and Other Financial Measures” within this press release.

(2) Capital management measure. Refer to “Non-GAAP and Other Financial Measures” within this press release.

(3) For assumptions utilized in the above guidance see “Future Oriented Financial Information” within this press release.

We currently have three drilling rigs active and will be adding a fourth drilling rig in the coming weeks. We look forward to reporting back on the extensive testing of new plays and play extensions over the coming months.

The company continues to achieve significant growth while spending less than our cash flow. As the business strategy continues to evolve, there will be an increased focus on returning excess free cash flow to shareholders. Headwater looks forward to providing clarity on these elements over the next 6 months.

Additional corporate information can be found in the Company’s corporate presentation and on Headwater’s website at www.headwaterexp.com

FOR FURTHER INFORMATION PLEASE CONTACT:

HEADWATER EXPLORATION INC. HEADWATER EXPLORATION INC.

Mr. Neil Roszell, P. Eng. Mr. Jason Jaskela, P.Eng.

Chairman and Chief Executive Officer President and Chief Operating Officer

HEADWATER EXPLORATION INC.

Ms. Ali Horvath, CPA, CA

Vice President, Finance and Chief Financial Officer

info@headwaterexp.com

(587) 391-3680

FORWARD LOOKING STATEMENTS: This press release contains forward-looking statements. The use of any of the words “guidance”, “initial, “anticipate”, “scheduled”, “can”, “will”, “prior to”, “estimate”, “believe”, “potential”, “should”, “unaudited”, “forecast”, “future”, “continue”, “may”, “expect”, “project”, and similar expressions are intended to identify forward-looking statements. The forward-looking statements contained herein, include, without limitation, revised 2022 guidance related to expected full-year and fourth quarter average daily production, capital expenditures and the breakdown thereof, adjusted funds flow from operations and adjusted working capital; the anticipation of drilling 18 further development and step-out locations in Marten Hills West over the balance of 2022; the plan to drill the Company’s first Clearwater A injection pilot in Marten Hills West prior to year-end 2022; the expectation to add a fourth rig and to drill 8 wells, testing 8 prospects starting early in the fourth quarter of 2022 in the Greater Peavine area; the expectation to have 65% of the field in Marten Hills under waterflood in the first half of 2023; the expectation to re-start McCully operations in the fourth quarter of 2022 and the future expectation of natural gas pricing in McCully; and the expectation to add a fourth drilling rig in the coming weeks. The forward-looking statements contained herein are based on certain key expectations and assumptions made by the Company, including but not limited to expectations and assumptions concerning the success of optimization and efficiency improvement projects, the availability of capital, current legislation, receipt of required regulatory approval, the success of future drilling, development and waterflooding activities, the performance of existing wells, the performance of new wells, Headwater’s growth strategy, general economic conditions, availability of required equipment and services, prevailing equipment and services costs, prevailing commodity prices and certain other guidance assumptions as detailed below under the heading “Future Oriented Financial Information” as set out below. Although the Company believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, risks associated with the oil and gas industry in general (e.g., operational risks in development, exploration and production; disruptions to the Canadian and global economy resulting from major public health events, the Russian-Ukrainian war and the impact on the global economy and commodity prices; the impacts of inflation and supply chain issues and steps taken by central banks to curb inflation; COVID-19 pandemic, war, terrorist events, political upheavals and other similar events; events impacting the supply and demand for oil and gas including the COVID-19 pandemic and actions taken by the OPEC + group; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to production, costs and expenses, and health, safety and environmental risks), commodity price and exchange rate fluctuations, changes in legislation affecting the oil and gas industry and uncertainties resulting from potential delays or changes in plans with respect to exploration or development projects or capital expenditures. Refer to Headwater’s most recent Annual Information Form dated March 10, 2022, on SEDAR at www.sedar.com, and the risk factors contained therein.

FUTURE ORIENTED FINANCIAL INFORMATION: Any financial outlook or future oriented financial information in this press release, as defined by applicable securities legislation, has been approved by management of the Company as of the date

hereof. Readers are cautioned that any such future-oriented financial information contained herein should not be used for purposes other than those for which it is disclosed herein. The Company and its management believe that the prospective financial information as to the anticipated results of its proposed business activities for 2022 has been prepared on a reasonable basis, reflecting management’s best estimates and judgments, and represent, to the best of management’s knowledge and opinion, the Company’s expected course of action. However, because this information is highly subjective, it should not be relied on as necessarily indicative of future results. The assumptions used in the revised 2022 guidance include: WTI US$96.30/bbl, WCS Cdn$101.70/bbl, AGT US$17.70/mmbtu, foreign exchange rate of US$/Cdn$ of 0.78, blending expense of WCS less $2.50, royalty rate of 20%, operating and transportation costs of $10.00/boe, financial derivatives losses of $1.25/boe, cash taxes of $4.40/boe and G&A and interest income and other expense of $1.30/boe. The AGT price is the volume weighted average price for the winter producing months in the McCully field which include January to April and November to December.

BARRELS OF OIL AND CUBIC FEET OF NATURAL GAS EQUIVALENT: The term “boe” (or barrels of oil equivalent) and “Mcf” (or thousand cubic feet of natural gas equivalent) may be misleading, particularly if used in isolation. A boe and Mcf conversion ratio of six thousand cubic feet of natural gas to one barrel of oil equivalent (6 Mcf: 1 bbl) is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Additionally, given that the value ratio based on the current price of crude oil, as compared to natural gas, is significantly different from the energy equivalency of 6:1; utilizing a conversion ratio of 6:1 may be misleading as an indication of value.

INITIAL PRODUCTION RATES: References in this press release to IP rates, other short-term production rates or initial performance measures relating to new wells are useful in confirming the presence of hydrocarbons; however, such rates are not determinative of the rates at which such wells will commence production and decline thereafter and are not indicative of long-term performance or of ultimate recovery. All IP rates presented herein represent the results from wells after all “load” fluids (used in well completion stimulation) have been recovered. While encouraging, readers are cautioned not to place reliance on such rates in calculating the aggregate production for the Company. Accordingly, the Company cautions that the test results should be considered to be preliminary.

NON-GAAP AND OTHER FINANCIAL MEASURES

In this press release, we refer to certain financial measures (such as free cash flow, total sales, net of blending and capital expenditures) which do not have any standardized meaning prescribed by IFRS. Our determinations of these measures may not be comparable with calculations of similar measures for other issuers. In addition, this press release contains the terms adjusted funds flow from operations and adjusted working capital, which are considered capital management measures. The term cash flow in this press release is equivalent to adjusted funds flow from operations.

Non-GAAP Financial Measures

Free cash flow

Management utilizes free cash flow to assess the amount of funds available for future capital allocation decisions. It is calculated as adjusted funds flow from operations net of capital expenditures.

Three months ended June 30, | Six months ended June 30, | |||

2022 | 2021 | 2022 | 2021 | |

(thousands of dollars) | (thousands of dollars) | |||

Adjusted funds flow from operations | 79,435 | 23,182 | 149,458 | 37,661 |

Capital expenditures | (30,860) | (16,781) | (112,817) | (54,053) |

Free cash flow | 48,575 | 6,401 | 36,641 | (16,392) |

Total sales, net of blending

Management utilizes total sales, net of blending expense to compare realized pricing to benchmark pricing. It is calculated by deducting the Company’s blending expense from total sales. In the interim financial statements blending expense is recorded within blending and transportation expense.

Three months ended June 30, | Six months ended June 30, | |||

2022 | 2021 | 2022 | 2021 | |

(thousands of dollars) | (thousands of dollars) | |||

Total sales | 130,153 | 40,038 | 249,415 | 65,530 |

Blending expense | (8,051) | (2,609) | (17,291) | (4,978) |

Total sales, net of blending expense | 122,102 | 37,429 | 232,124 | 60,552 |

Capital expenditures

Management utilizes capital expenditures and capital expenditures including acquisition to measure total cash capital expenditures incurred in the period. Capital expenditures represents capital expenditures – exploration and evaluation and capital expenditures – property, plant and equipment in the statement of cash flows in the Company’s interim financial statements netted by the government grant.

Three months ended June 30, | Six months ended June 30, | |||

2022 | 2021 | 2022 | 2021 | |

(thousands of dollars) | (thousands of dollars) | |||

Cash flows used in investing activities | 35,663 | 30,079 | 116,037 | 38,339 |

Restricted cash | – | 240 | (5,000) | 1,477 |

Change in non-cash working capital | (2,212) | (13,538) | 4,371 | 14,237 |

Government grant | (2,591) | – | (2,591) | – |

Capital expenditures | 30,860 | 16,781 | 112,817 | 54,053 |

Capital Management Measures

Adjusted Funds Flow from Operations

Management considers adjusted funds flow from operations to be a key measure to assess the Company’s management of capital. In addition to being a capital management measure, adjusted funds flow from operations is used by management to assess the performance of the Company’s oil and gas properties. Adjusted funds flow from operations is an indicator of operating performance as it varies in response to production levels and management of production and transportation costs. Management believes that by eliminating changes in non-cash working capital and deducting current income taxes, adjusted funds flow from operations is a useful measure of operating performance. While current income taxes will not be paid until 2023, management believes adjusting for current income taxes in the period incurred is a better indication of the funds generated by the Company.

Three months ended June 30, | Six months ended June 30, | |||

2022 | 2021 | 2022 | 2021 | |

(thousands of dollars) | (thousands of dollars) | |||

Cash flows provided by operating activities | 84,728 | 23,232 | 145,417 | 36,015 |

Changes in non–cash working capital | 200 | (50) | 15,350 | 1,646 |

Current income taxes | (5,493) | – | (11,309) | – |

Adjusted funds flow from operations | 79,435 | 23,182 | 149,458 | 37,661 |

Adjusted Working Capital

Adjusted working capital is a capital management measure which management uses to assess the Company’s liquidity.

As at June 30, 2022 | As at December 31, 2021 | |||

(thousands of dollars) | ||||

Working capital | 127,101 | 89,775 | ||

Contribution receivable (long-term) | 671 | – | ||

Repayable contribution | (4,132) | – | ||

Financial derivative receivable | (130) | (770) | ||

Financial derivative liability | 6,696 | 3,924 | ||

Adjusted working capital | 130,206 | 92,929 | ||

Non-GAAP Ratios

Adjusted funds flow netback, operating netback and operating netback, including financial derivatives

Adjusted funds flow netback, operating netback and operating netback, including financial derivatives are non-GAAP ratios and are used by management to better analyze the Company’s performance against prior periods on a more comparable basis. Adjusted funds flow netback is defined as adjusted funds flow from operations divided by sales volumes in the period.

Operating netback is defined as sales less royalties, transportation and blending costs and production expense divided by sales volumes in the period. The sales price, transportation and blending costs, and sales volumes exclude the impact of purchased condensate. Operating netback, including financial derivatives is defined as operating netback plus realized gains or losses on financial derivatives.

Adjusted funds flow per share and net income per share

Adjusted funds flow per share and adjusted net income per share are non-GAAP ratios and are used by management to better analyze the Company’s performance against prior periods on a more comparable basis. Adjusted funds flow per share and net income per share are calculated as adjusted funds flow from operations or net income divided by weighted average shares outstanding on a basic or diluted basis.

Per boe numbers

This press release represents various results on a per boe basis including Headwater average realized sales price, net of blending, financial derivatives gains (losses) per boe, royalty expense per boe, transportation expense per boe, production expense per boe, general and administrative expenses per boe, interest income and other expense per boe and current taxes per boe. These figures are calculated using sales volumes.